Diving deeper into Lightning liquidity: Amboss Magma

As we continue developing the Ark protocol, understanding liquidity costs has become essential. Our previous research into bitcoin yield products revealed that Lightning liquidity leasing offers some of the most attractive self-custodial yields in bitcoin—typically 1-4% APR while maintaining custody of your funds.

To inform our fee structure for the Ark protocol, we want to dig deeper into the mechanics of bitcoin liquidity pricing. Since Ark servers must deploy their own bitcoin treasury to enable Lightning payments, refreshes, and offboards, understanding the true cost of liquidity deployment directly impacts what we'll need to charge users.

Amboss Magma emerged as the obvious place to look: it's the most mature and liquid market for Lightning liquidity. It handles a large share of all completed public bitcoin liquidity lease orders. The rates being paid there may be the best representation we have of the real opportunity cost and risk premium for locking up bitcoin to facilitate payments.

What is Amboss Magma?

Amboss Magma operates as a peer-to-peer marketplace where Lightning users can buy and sell channel liquidity. Lightning nodes that need inbound liquidity to receive Lightning payments can purchase it from liquidity providers who earn yield by temporarily locking up their bitcoin in channels.

A few key terms for understanding the marketplace:

- PPM (parts per million): The fee rate per satoshi, where 10,000 PPM equals 1%. Since there are 100 million satoshis in one bitcoin, this provides a precise way to price small amounts. Imagine them like basis points, but even smaller!

- Channel capacity: The total value of a Lightning channel, denominated in satoshis.

- APR (Annual percentage rate): Annualized returns calculated from lease terms, often extrapolated from shorter durations since most leases aren't exactly 365 days.

- LINER: Amboss's benchmark rate tracking system that monitors yield curves over time.

Our analysis

We built our dataset directly from the Amboss Magma API, using both active listings of unfilled offers and historical records of completed Lightning channel purchases. To ensure the data reflected realistic market activity, we removed outliers with high rates. This excluded two categories:

- Filled orders above 20% APR, which were rate and not representative of typical usage, and,

- Unfilled listings where lessors asking for unrealistically high APRs but never secured completed orders.

The data reveals several fascinating patterns about how bitcoin liquidity gets priced.

Size matters: Channel fee premiums

There are economies of scale when it comes to leasing liquidity. Small channels reflect higher PPM rates.

For example, it is more expensive on a per-satoshi basis to open a 0.5 million sat channel than a 1.0 million sat channel, even though the total up front cost can be lower.

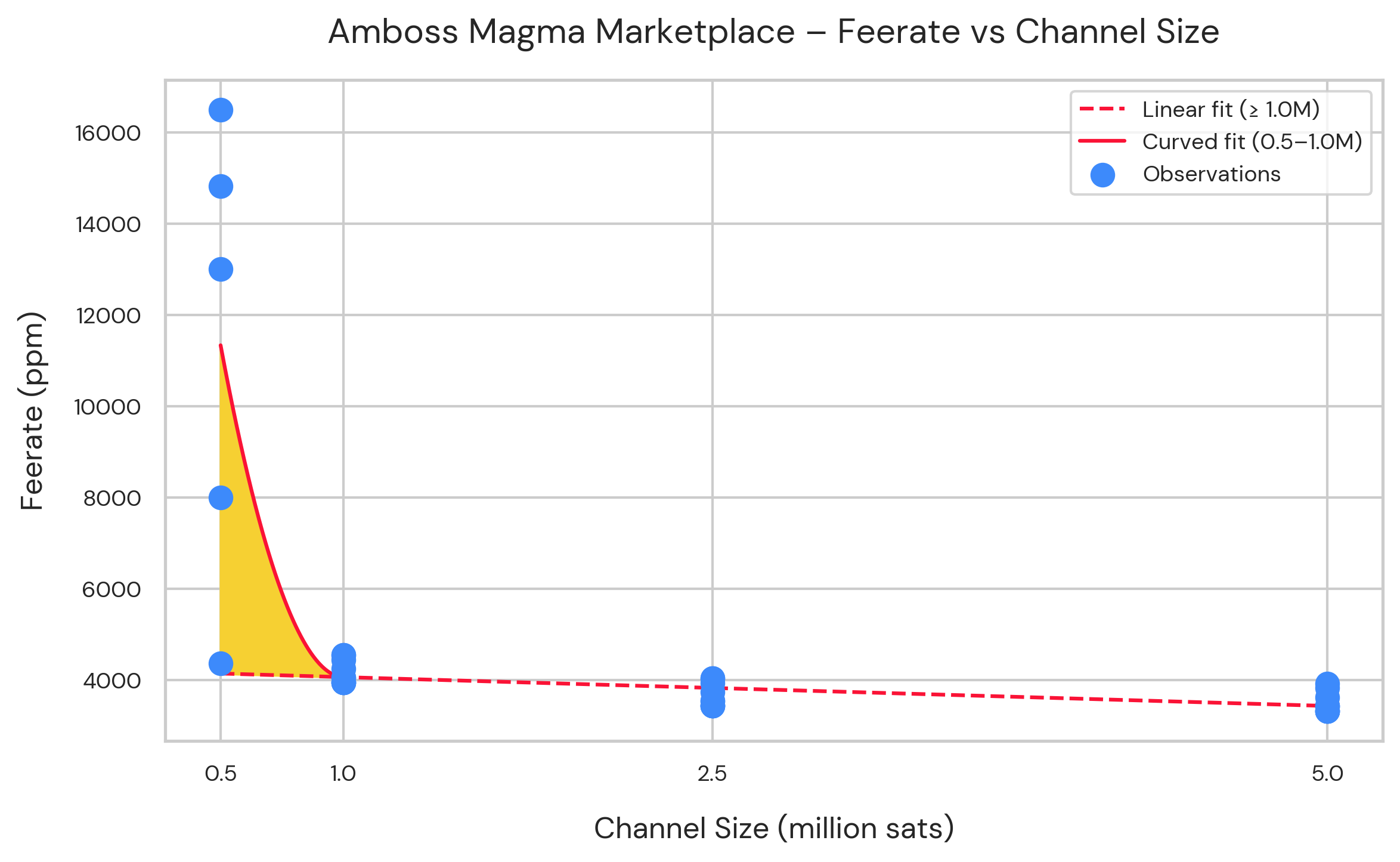

The following chart shows fixed-size Lightning channels listed for sale on Amboss Magma in July 2025. The sample includes channels of 0.5, 1.0, 2.5, and 5.0 million sats each. At a Bitcoin price of $120,000 USD, a 0.5M sat channel corresponds to $600, while a 1.0M sat channel corresponds to $1,200.

The highlighted yellow area shows how smaller channels command a premium in fee rates. In particular, channels below 1.0M sats ($1,200 USD) are priced disproportionately higher relative to their size. By contrast, channels above this threshold exhibit a more consistent and predictable relationship, closely following the linear trend line without significant deviations.

This happens for three reasons:

-

Fixed costs: Amboss charges a flat 500 PPM fee on every order, which represents a larger percentage of smaller transactions.

-

Setup overhead: Opening any Lightning channel requires on-chain transaction fees and operational overhead, regardless of size.

-

Supply and demand: Small channels are popular with newcomers testing Lightning or users seeking cheap inbound liquidity rebalancing. High demand combined with thin supply (node operators prefer opening larger channels for the same on-chain cost) creates pricing power for sellers.

In summary, the data makes it clear that smaller Lightning channels come at a disproportional premium price, driven by structural costs and market dynamics. For participants, this means the most “affordable” entry point is not necessarily the cheapest channel size, but rather the one that balances cost efficiency with intended use. Above 1.0M sats, pricing normalizes and reflects a more rational, linear relationship, suggesting that economies of scale dominate once fixed costs are absorbed.

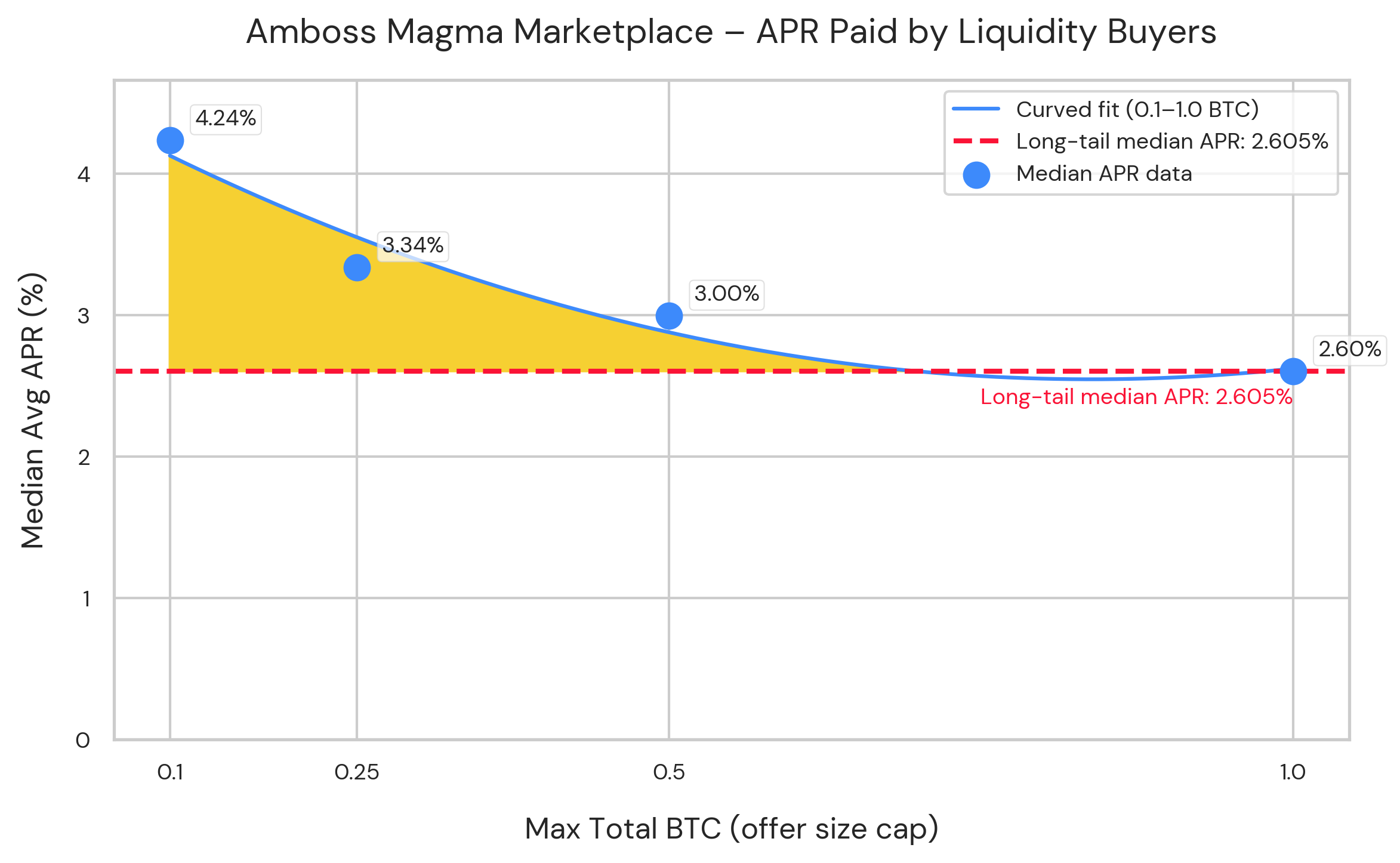

Liquidity offers: A tale of two markets

In this section, we analyze a selection of open liquidity offers on Amboss Magma. These represent the active listings currently available in the marketplace, rather than completed orders.

Two clear market segments emerge:

-

High-premium small channels: Channels under 1 BTC capacity show the highest APRs, often exceeding 4%. These higher APRs don’t actually translate into greater yields for providers, however, since much of what customers pay goes toward covering miner fees to post the on-chain transaction. Structurally, Lightning has many participants operating at small sizes, so demand is concentrated in this sub-$10,000 USD range. With high demand and thin supply (most node operators prefer to lease larger channels for the same on-chain cost), sellers can command premium pricing.

-

Efficient large channels: Channels above 1 BTC capacity cluster around 2.6% APR, which reflects the mature market rate for deploying substantial liquidity. This segment shows a diminishing premium pattern, with rates stabilizing and closely following the market average.

The median APR across all listings aligns with the mean, around 2.6%, confirming that this is the market consensus for Lightning liquidity. Amboss has reported historical returns between 1–4%, and the midpoint of that range (≈2.5%) is nearly identical to what our analysis of open offers reveals. While users can technically earn up to ~4.24% by selling liquidity in smaller chunks, the more stable long-tail result converges on the 2.5–2.6% range.

In short, the premium zone exists below 1 BTC, where APRs regularly exceed 4%. Beyond that threshold, liquidity pricing flattens, with offers in the greater than 1 BTC converging around 2.6%—a rate that matches both Amboss’s reported rates and our broader research into bitcoin yield markets.

Network effects on pricing

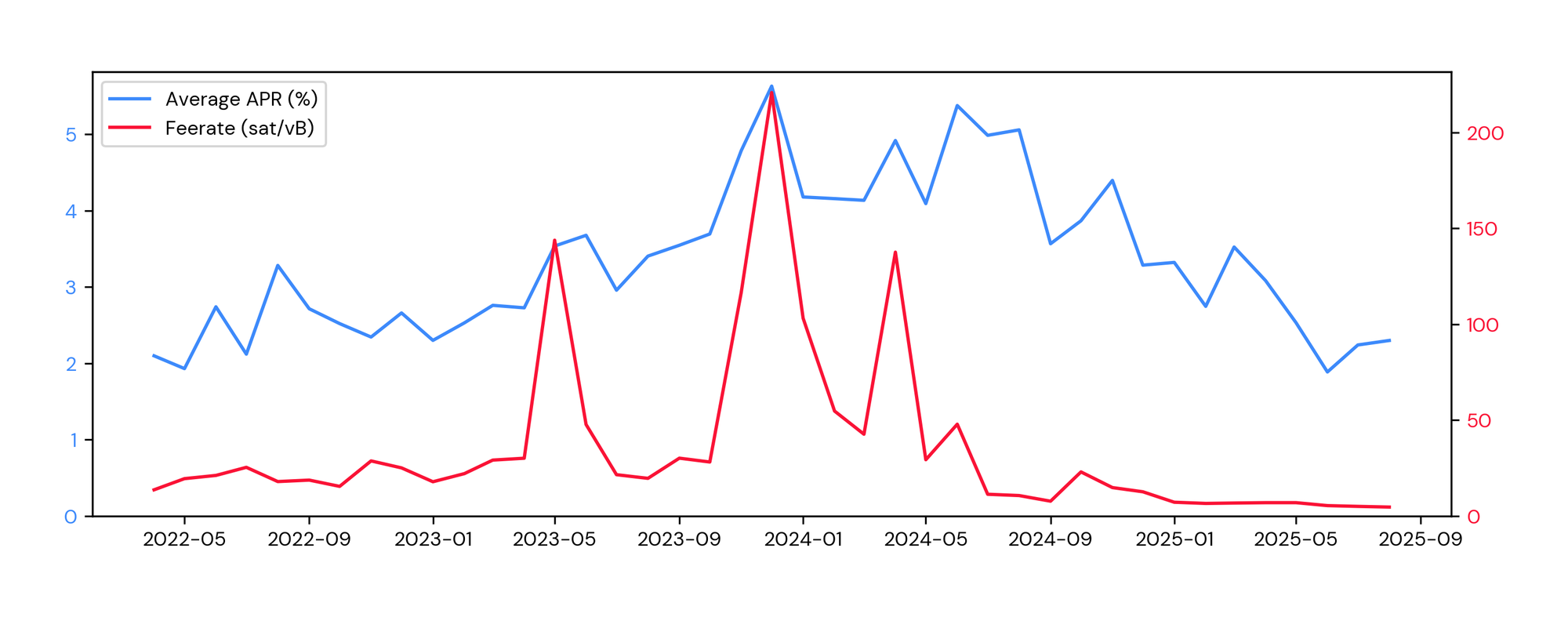

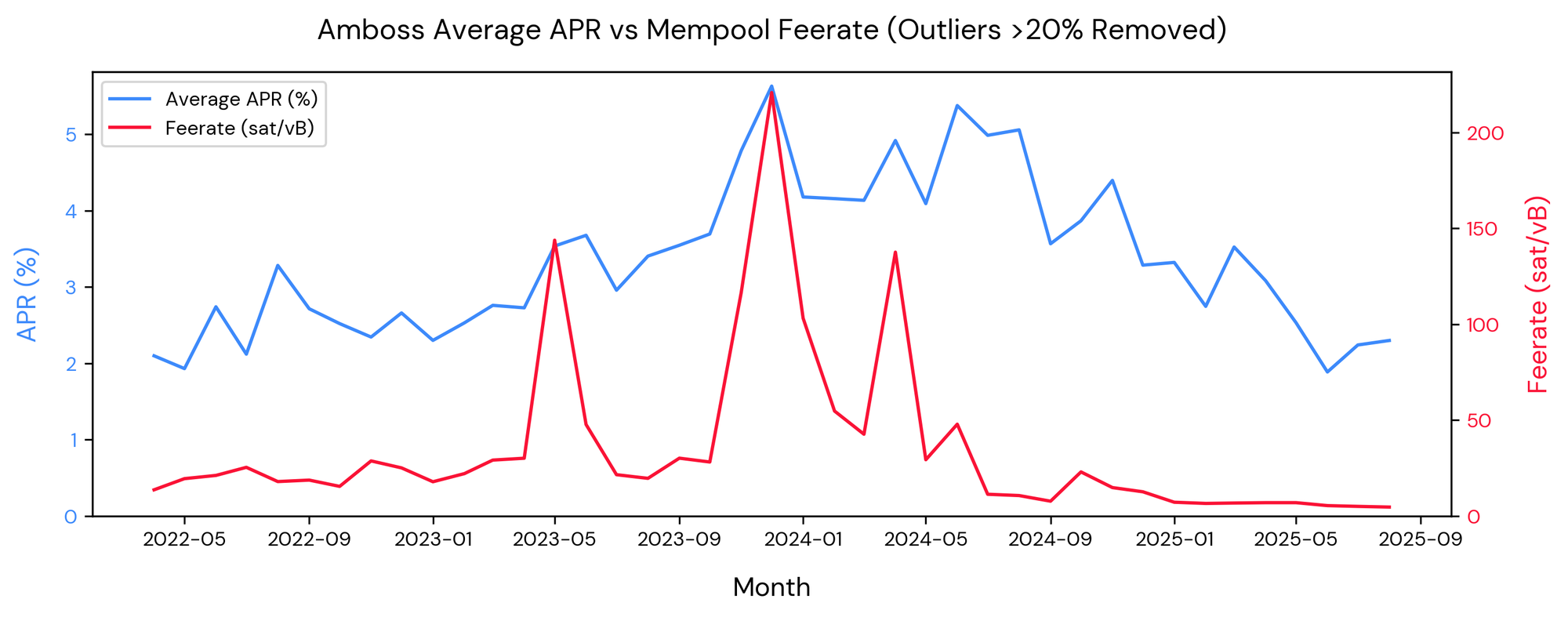

The correlation between on-chain feerates and Amboss APRs reveals another important dynamic. When bitcoin network fees spike, APRs for smaller channels increase much more dramatically than for larger ones.

This makes economic sense: fixed on-chain fees represent a much larger share of the total cost for small channels. The underlying yield earned by liquidity providers doesn’t actually rise—what changes is the cost burden on buyers, with higher transaction fees being passed on.

Comparing alternatives

To validate Amboss’s position as the dominant liquidity marketplace, we examined Core Lightning’s liquidity ads feature. At first glance, the economics appear attractive—rates that could theoretically annualize to 40% APR. In practice, though, the story is quite different.

Liquidity ads typically offer 4-day lease periods at about 0.44% per lease. But the market suffers from extremely low activity, with fulfillment sporadic at best. These advertised rates are supply-side intentions, not actual executed trades, which makes realized returns highly uncertain.

This contrast reinforces Amboss Magma’s role as the most reliable source of market data—because it’s where liquidity trades actually happen at scale.

What this means for the Ark protocol

Amboss Magma is emerging as the benchmark rate for Lightning liquidity leasing. The marketplace is steadily maturing into a stable, efficient and transparent mechanism for pricing the cost of locking up bitcoin to support payments.

Our research highlights two crucial dynamics:

- Economies of scale dominate: channel sizes above ~$1,200 (1.0M sats at $120k BTC) converge around predictable rates near 2.6% APR.

- Smaller channels show persistent inefficiencies. In this range, buyers routinely face disproportionately high premiums, paying much more per satoshi for liquidity. Addressing this imbalance presents a key opportunity: enabling users with smaller balances to maintain self-custody without being penalized by excessive fee structures.

For Ark, these insights are foundational. This research provides crucial background for us defining Ark fee structures. Understanding the true cost of liquidity deployment is going to help us ensure that Ark offers competitive rates while maintaining sustainable economic incentives for a bitcoin payment technology.

Most importantly, the data validates that Lightning is consistently generating sufficient utility for users to support market-competitive yield rates across a range of market conditions and payment sizes. The utility of bitcoin payments is real, and great news for Ark!