A survey of bitcoin yield: What's the opportunity cost of Ark liquidity?

As we continue the study of Ark’s liquidity requirements, we must come to an understanding on how to price liquidity. Many user operations on Ark require an Ark server to lock up bitcoin (e.g., refreshes, Lightning payments, and offboards), which has an inevitable cost of capital associated with it.

To inform our liquidity pricing plans, we decided to embark on an examination of a wide spectrum of bitcoin yield products, to see what we could learn about the prevailing market rates for bitcoin yield—what the range is, what drives higher/lower rates, and where Ark might fit.

Below are our findings!

Categories of bitcoin yield

In our research, we identified four broad categories of services offering bitcoin yield. These are:

- Exchange savings: Users give up custody of their bitcoins to a retail crypto exchange. They usually “one-click” earn a low rate on their bitcoin.

- DeFi: Users drop wrapped BTC into on-chain vaults and apps for a yield. Less human custodial risk, but more smart contract risk.

- Funds: Bitcoin-denominated, structured financial instruments for accredited investors and institutions.

- Lightning liquidity: The market for Lightning channel liquidity leasing, where users earn a yield for leasing out inbound liquidity to other users.

We decided to exclude the most degenerate of DeFi products, of which there are many, so if you think something is missing here, that's probably why!

Note that inclusion in our research below does not indicate endorsement!

Summary of results

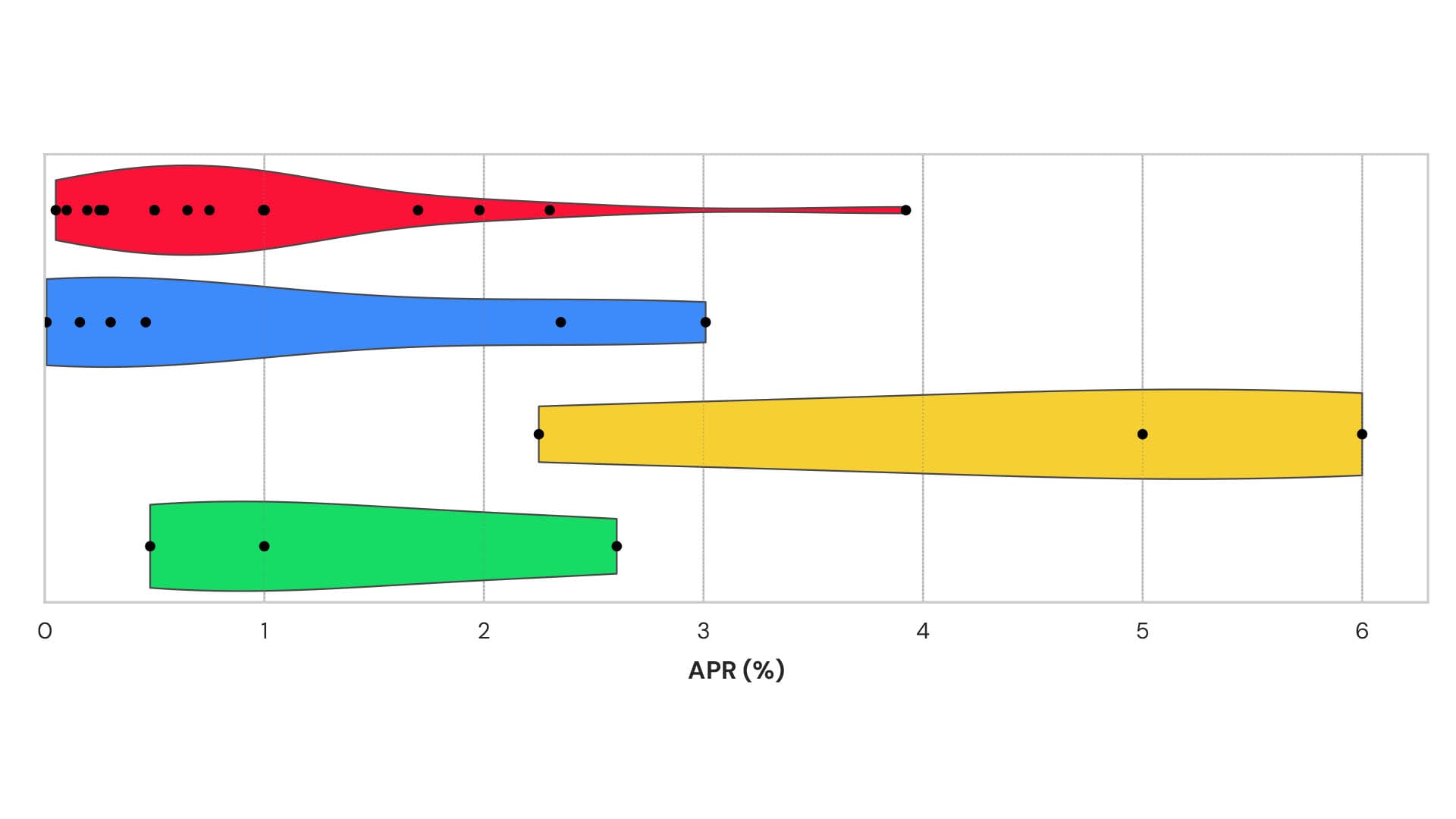

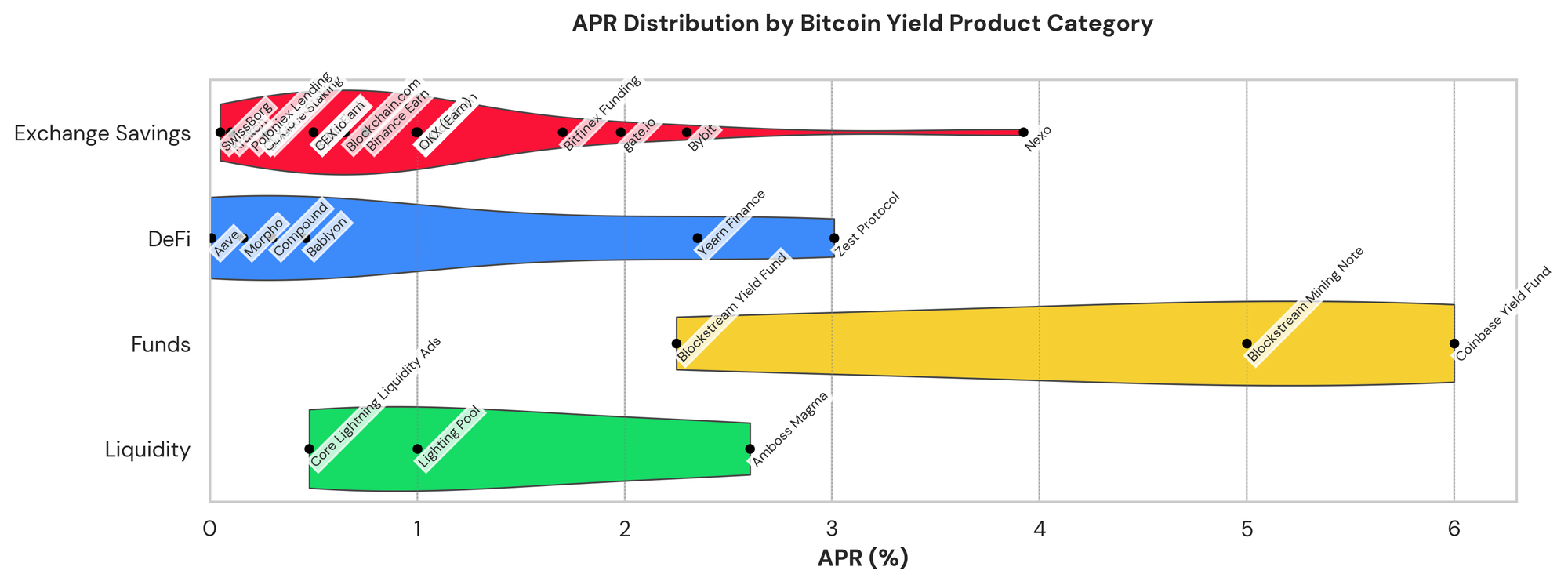

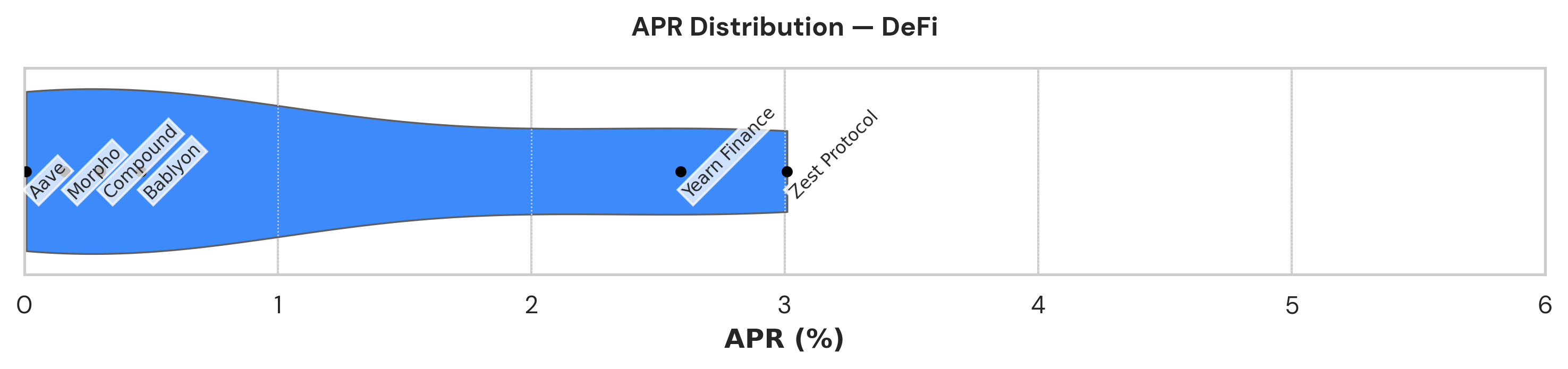

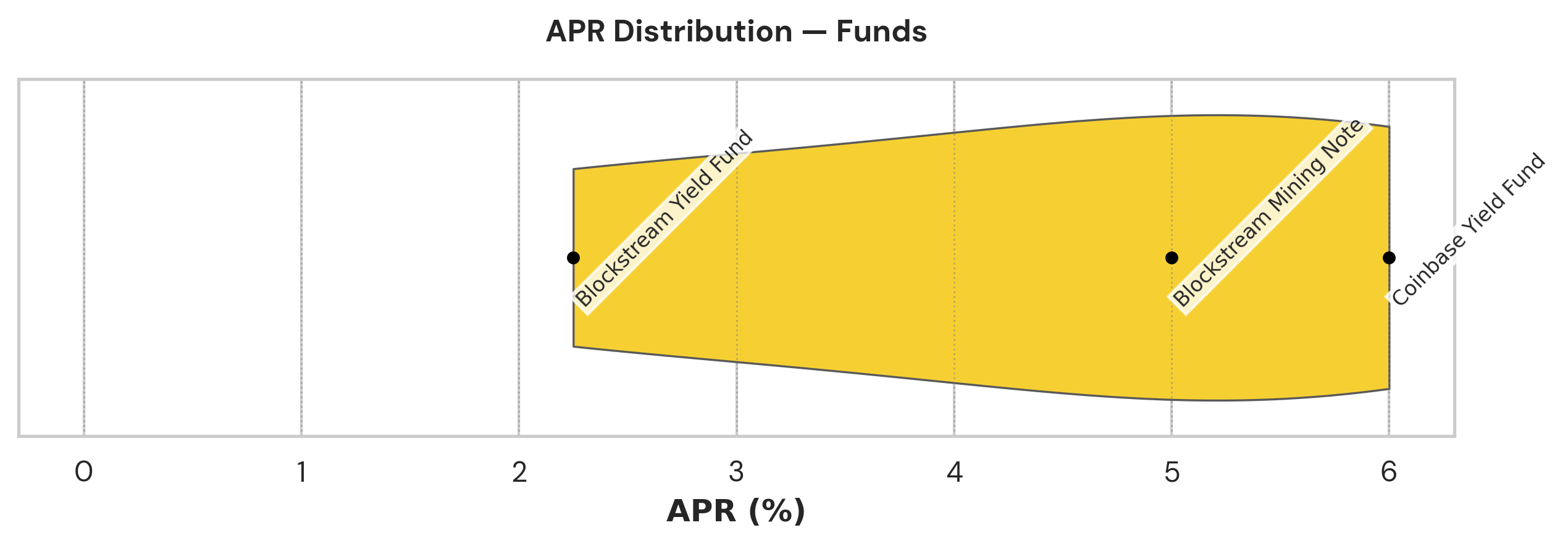

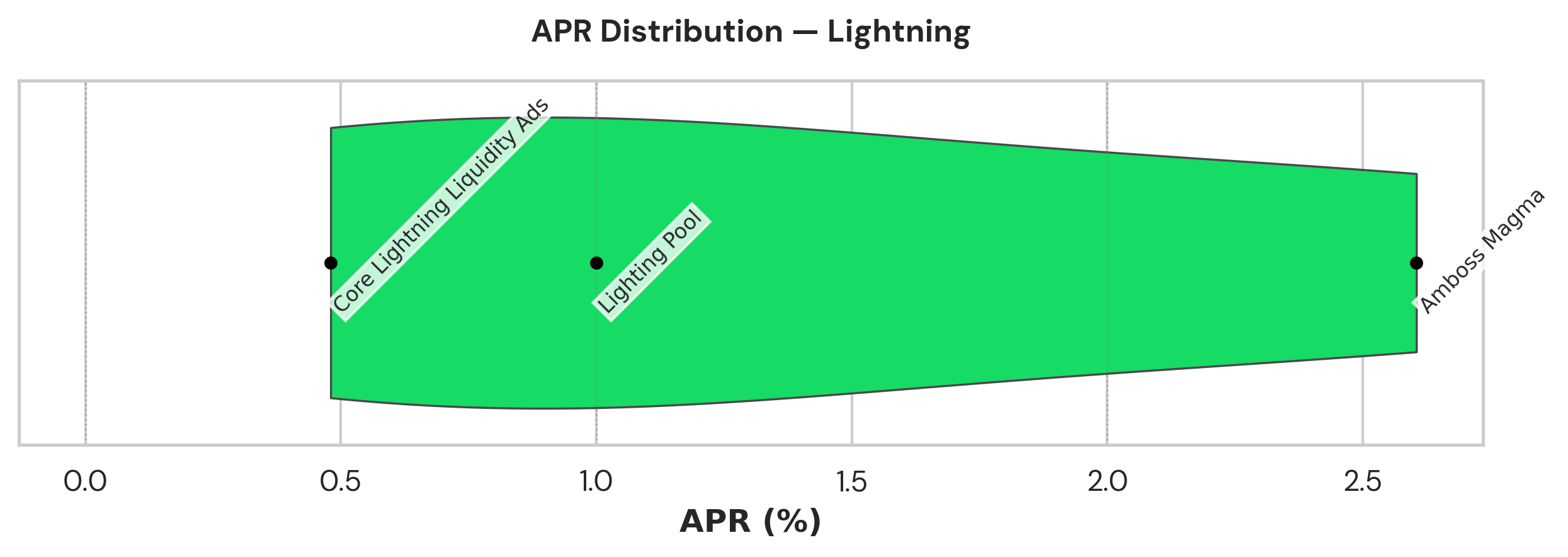

This chart is a violin plot of APR paid in bitcoin across all the services included in our survey. The results are broken down by category.

Each coloured “violin” shows the distribution of observed APRs for a category: where the shape is wider, more products cluster around that rate of return.

Note how at the top the “exchange savings” category offers many products in a sub-1% range, and only a single outlier sits at the 3-4% range. Similarly we can spot Zest Protocol as an outlier in the DeFi category, as we know it is a “boosted” product that was recently launched and is able to subsidize its yield offerings.

| Category | APR* | Keep custody? | Technically accessible? |

|---|---|---|---|

| Exchange | < 1%** | ❌ | ✅ |

| Funds | 2.5% - 6% | ❌ | ✅ |

| DeFi | 0.008% - 3% | ❌ | Some geekiness required 🤓 |

| Lightning | 1% - 4% | ✅ | Some geekiness required 🤓 |

* To help make comparisons more straightforward, we've normalized any rates advertized in APY to the slightly lower APR rate.

** Some outliers claiming yields up to 4%

An important distinction to highlight is that the yield services in the exchange and funds categories require investors to give up custody of their bitcoin, but those in the DeFi and Lightning categories do not (okay, so perhaps debatable with some DeFi services!).

This is offset by the convenience for retail and institutional investors when using the centralized exchange and fund services respectively. These products are accessible—no technical knowledge required.

On the other hand, using DeFi and Lightning requires time, effort, and technical capability beyond what is expected of the average investor. The products of these two categories fill a similar band in both market segment and APR bitcoin yield.

Let's take a closer look at the bitcoin yield in each category.

Exchange savings

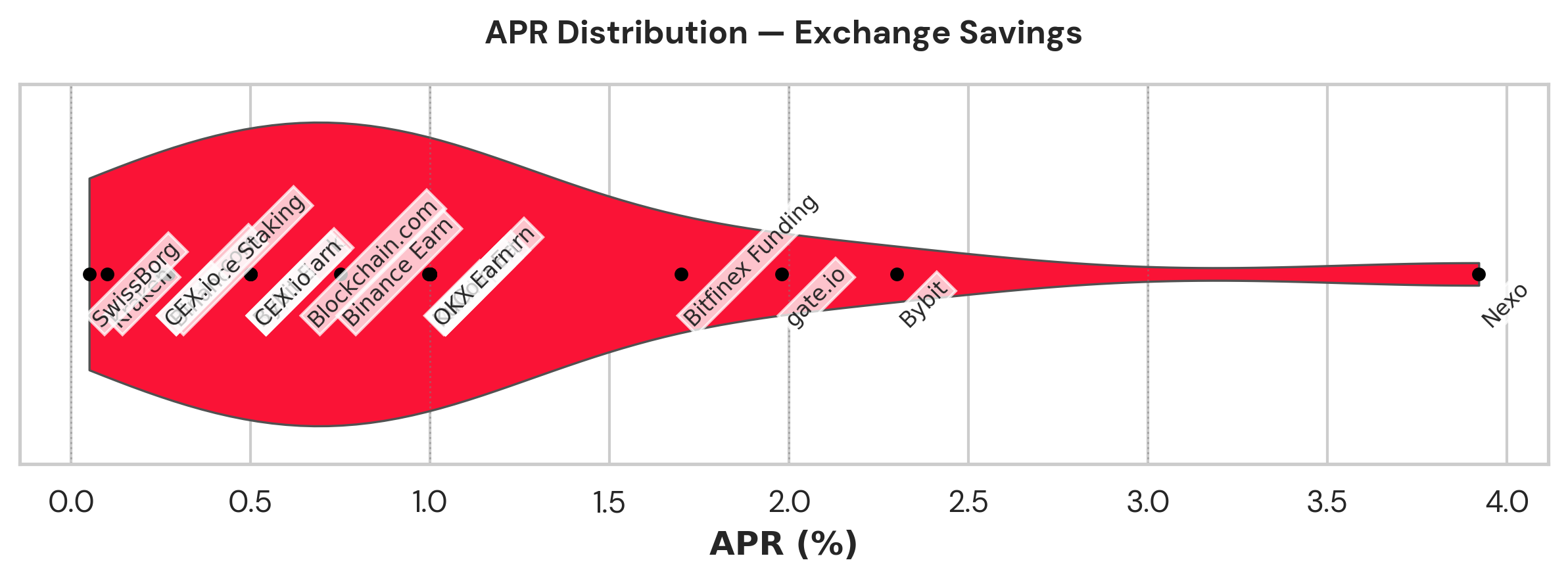

The exchange savings category encompasses products offered by retail crypto exchanges to the mass market. Users typically purchase bitcoin and hold it custodially on the exchange, where users can simply click "earn" and lock up their holdings in exchange for yield. Beyond retail crypto exchanges with "earn" tabs offering one-click bitcoin yield generation, some platforms extend into yield products and other neobank services.

There's a pretty wide range of mechanisms that exchanges use to finance their retail bitcoin-yield offers. Some, such as Binance, lend customer BTC to on-platform margin or loan desks; the borrowers' interest funds the advertised APRs.

Platforms also route BTC (or stable-coins raised against it) into on-chain staking or liquidity programs and collect protocol rewards before passing a fraction to depositors; Binance's "On-chain Yields" documents this flow.

Newer services, such as Kraken's Babylon integration, lock bitcoin in native-chain smart contracts that help secure proof-of-stake networks and pay rewards in a separate token rather than by lending the coins out. Some exchanges, notably Crypto.com, emphasise that they conduct any such activity on their own balance sheet and "do not lend to third parties".

The majority of these products offer yields below 1% APR. Rates remain low because the supply of retail users is large, who often leave their bitcoin idle on exchanges. The yield offered by these services functions more as a "retention hook" than an investment product, raising retail users' switching costs and nudging casual holders to keep their bitcoin parked on the exchange rather than self-custodying.

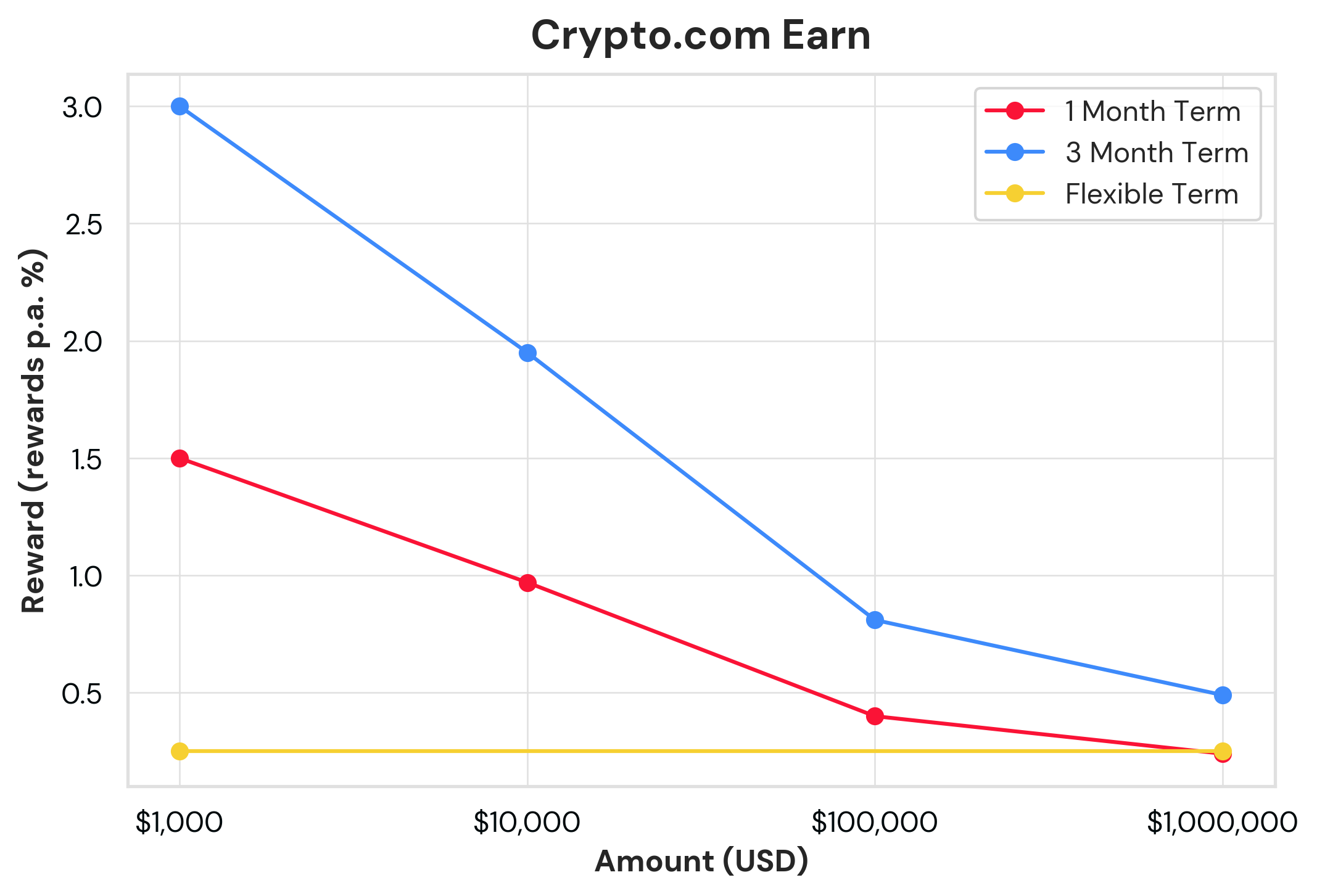

However, some platforms claim higher yield rates, such as Crypto.com, Bybit, and Nexo. For example, Bybit's 2.30% yield might look enticing, but it's important to be aware that after a February 2025 hack drained approximately $1.4 billion in ETH, the platform raised rates to prevent customer withdrawals and attract new users to compensate for lost liquidity. The rate could be subsidized to regain trust rather than reflect a genuinely stronger offering. Crypto.com's rates may also look high on first glance, but on closer inspection (see chart below), you'll see that most users fall into the "flexible term" category, which provides only a 0.25% APR bitcoin yield. The higher rates are only achieved through limited-time offers and fixed-term lending contracts at 1-month and 3-month intervals.

In short, this category offers the lowest yield of any category in our survey, while exposing users to a variety of counterparty risks.

DeFi's bitcoin yield

The bitcoin DeFi yield products we surveyed use custodial "wrapped bitcoin" (like WBTC, cbBTC, or sBTC) instead of native bitcoin. Users log into crypto DeFi apps, connect their wallets, then lock up wrapped bitcoin tokens into liquidity pools or lending/borrowing platforms. Many protocols will insist on users to deposit bitcoin together with a stablecoin.

In this category, custody is distributed across multiple entities through multisig and smart contracts, so you reduce the risk of a single counterparty with unilateral control (like exchange savings and funds). But instead, you're exposed to a new "smart contract risk", where a bug, oracle glitch, or bridge exploit can drain the vault and the wrapped bitcoin is gone for good. DeFi protocols can be very complex and face unknown vulnerabilities. Over just the last five years, exploits have erased over 2,200 bitcoin in total (over $250 million in value)—including incidents like BadgerDAO's $120M hack and address poisoning attacks worth $68M.

Another risk in DeFi—you can become the yield, through impermanent loss (where price movements between paired assets leave you worse off than simply holding bitcoin) or liquidation. These products aren't minting value out of thin air, but rather siphoning it from traders on the other side of the pool or other liquidity providers caught off-guard. The game is typically zero-sum, and one person's APR yield is another's slippage or liquidation penalty.

As total value locked (TVL) rises in a particular DeFi product or pool, more capital is competing for the same demand so the yield per unit falls. This is the case for applications such as Aave that grow to billions in TVL, and the yield percentage APR trends lower. Zest Protocol, a Stacks-based lending market, stands out as the outlier in the DeFi category with rates up to 3%. We'd assume this is because its pool is still small and subsidized—headline rates are padded by a questionable "STX token boost".

Bitcoin yield funds

The funds category is defined by institutional products sold to accredited investors often through licensed securities venues. These products are tightly regulated, open only to accredited investors.

This is arguably the most diverse category, with yields generated from a wide variety of activities such as electricity arbitrage, lending, and market making activities. For example, mining backed notes (such as the Blockstream Mining Note) allow customers to swap their bitcoin for a slice of bitcoin hashrate, with users earning yield from block rewards and transaction fees. The Coinbase Bitcoin Yield Fund (CBYF) generates yield from basis trading and arbitrage.

The premium 5-6% yields offered by products in this category are arguably a product of sophisticated strategies and asymmetric opportunities. Most of these products concentrate their risk in a single specialist strategy. While the broad investment strategy and targeted returns are disclosed publicly, the details of subscription terms and risk disclosures are provided confidentially to accredited investors only (typically under NDA). The purchasers of these financial instruments are typically exposed to a variety of ideosyncratic risks, for example with mining: variable blockspace demand and infrastructure risks.

If these strategies don't work out and the fund does not make the yields, then there is no payout to the investors. There is no guarantee that you will maintain your initial investment, just like any security.

Leasing Lightning liquidity

While individual users can earn yield from routing fees on Lightning, we've focused on liquidity leasing only. Currently, there are no services that offer yield from routing fees, but there are a handful that support the earning of yield for liquidity leasing.

Leasing Lightning liquidity is also the closest analogue to liquidity on the Ark protocol, making it the most relevant bitcoin yield category to us!

In this category, users lock up bitcoin in channels to supply inbound liquidity for others who need to receive bitcoin payments over Lightning. These services operate as marketplaces that match liquidity suppliers with those who need it, rather than taking custody and deploying the bitcoin themselves. Liquidity suppliers retain custody of their bitcoin throughout—they simply can't use it for other purposes while it's locked up. The liquidity is typically provided on a fixed-term basis, with the expectation that channels will be closed and remaining bitcoin returned to the liquidity supplier when the term ends (though this doesn't always happen).

This is still a fledgling category, with only a few operators. The last four years of data indicate Amboss Magma yields between 1-4% APR, and we went with 2.6% as the average rate for our charts. Higher yields tend to be for smaller amounts and shorter periods, and the lower yields were for larger amounts on longer periods. Given that Amboss Magma stands out as the only well-established Lightning liquidity market with market makers, a full order book, and web interface, we'll be diving deeper into the dynamics of the Amboss marketplace in a dedicated article soon!

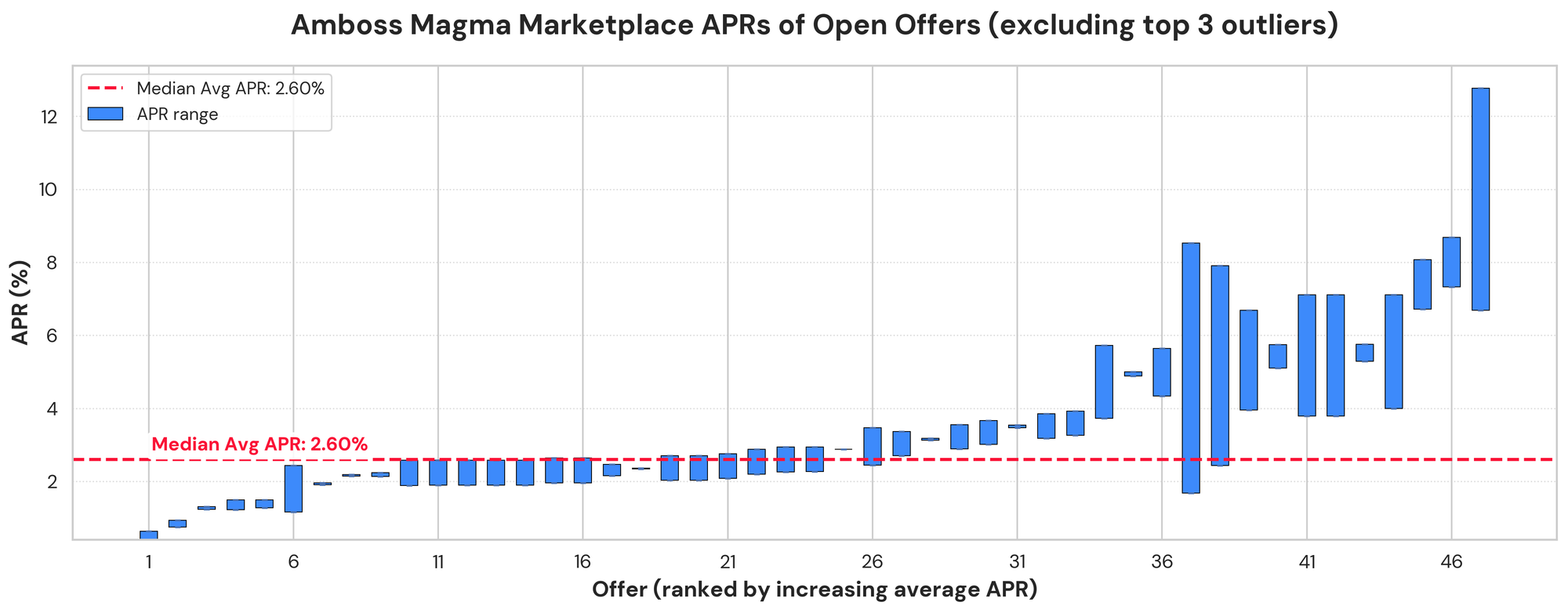

The above chart shows the current open offers on Amboss Marketplaces to sell Lightning liquidity, having removed three outliers in the 25% and up range. This is how we observe the 2.6% median value of an open offer, which is right in the midpoint of the advertised 1-4% APR range. The offers with the greatest variability show the highest rates, and represent offers of a smaller relative bitcoin size.

Lightning Pool is another non-custodial marketplace for leasing Lightning channel capacity through auctions, designed for advanced users. At the time of writing, we queried an lnd node to return a list of confirmed orders within the last two weeks. There were only two orders in this time—both sold for a 2.53% fee to borrow sats for a 14-day period. Annualizing that rate over a year would be equivalent to a yield of about 66.2% APR - with no compounding of yield. However, the volume of completed orders appear to be very low.

Core Lightning's liquidity ads are a decentralized marketplace feature built into the Lightning protocol itself. At the time of writing, we found 35 open offers on the supply side, with fees ranging from 0.10-1.20% for lease periods of approximately four days. The period-adjusted median rate is 0.44%, which would correspond to 40.2% APR if orders were continuously filled. However, the market has low volume—those advertised terms lack enough demand to convert to continuous leases, significantly reducing actual yield. These figures represent supply-side intent to sell, without guaranteed matches. While the headline economics look attractive on paper, sporadic fills mean actual returns are uncertain.

While it's clearly still a maturing category, it's exciting to see such high yields being achieved in Lightning liquidity leasing. Bitcoin-denominated yield is not easy to achieve, and these yields demonstrate the users are getting sufficient utility from Lightning payments to cover the prevailing opportunity costs for liquidity suppliers. Lightning yield is especially attractive because you don't have to give up custody—you're just putting your bitcoin into a simple, battle-tested script!

What drives bitcoin yield rates

Embarking on this research, we didn't realize the level of complexity in bitcoin yield products. Multiple competing factors affect the rates being achieved. Convenience is critical—easier solutions attract more participants, driving yields down, while solutions requiring technical expertise attract fewer participants, creating higher yields (when demand exists!).

Risk and reward follow the expected pattern—higher-risk strategies must offer higher yields, while perceived lower-risk options offer less. Custody is a key component of risk. Self-custodial solutions should theoretically offer lower yields since they're arguably less risky than handing bitcoin to third parties. In reality, exchange savings products offer very low rates despite massive custody risk—they overcome this through convenience and targeting users who wouldn't self-custody anyway.

Michael Saylor has, at least once, claimed there should be a 5% risk-free rate in bitcoin, but our research shows there's no such thing as truly risk-free—even self-custodial solutions face risks like node hacks, key compromises, or protocol vulnerabilities. Nothing that looks sustainable is offering anything close to 5%.

Implications for the Ark protocol

This survey demonstrates consensus forming on the opportunity cost of deploying bitcoin capital—roughly 1-4% annually. We'll use these findings to inform how we price liquidity in the Ark protocol, which will affect the cost of Lightning payments, refreshes, and offboards.

Another consideration is that while Ark servers will likely start by deploying their own bitcoin treasury for liquidity, as adoption grows, they may need to source bitcoin from third parties. This could lead to additional yield demands to cover the increased custodial risk.

As with anything in bitcoin, things will continue to change fast and we'll continue to review.